Filing My Own Income Taxes

My tax season is in February, since I try to get everything done as soon as possible when all my tax forms arrive. I have (almost) always filed my own tax returns, and sometimes I wish it was a little easier.

I know this is an “only in America” problem and I do have opinions about this. However, tax reform is a huge subject and I won’t claim to be an expert. Still, even within the current system I think there’s a major issue: It’s not easy to file electronically…without using commercial tax-preparation software.

Paying to Pay Taxes

When people file electronically, they normally do this through commercial software (or they hand their paperwork to a professional who uses commercial software). I’ve made it a point to avoid this software ever since I read The TurboTax Trap, a series of articles from ProPublica that details how creators of tax-preparation software lobbied the government to stifle a government-run online service to file taxes. (You can also watch this video from the New York Times that highlights a lot of the same key points.)

Maybe this is unfair to other companies since it seems like most of the shenanigans have come from Intuit (maker of TurboTax). But still, I do think there should be a way to do this online provided as a public service.

Some Free Options

There are actually ways to to file your taxes online without paying for commercial software, but there are important caveats.

First, there’s IRS Direct File, which is the government-run online service that’s long overdue. As far as I can tell, it provides an experience similar to that of commercial software. It’s currently available to people in certain states with certain types of income. California is one of the eligible states, but taxable investment income (dividends and capital gains) is one type of income that’s not included, so I can’t use the software. I do hope this program continues to be expanded, because this is the sort of thing I think people should be using.

Next, there’s the older IRS Free File program. This is a program that allows people under an income threshold ($84,000 for tax year 2024) to use certain commercial software for free to file federal returns (and state returns in some cases as well). I haven’t used this because my income is normally higher than the threshold, and it’s still using commercial software which I want to avoid.

(Side note: Even if you don’t qualify for Free File, some of the software from the Free File providers is still free for federal returns, or possibly cheaper than TurboTax or H&R Block. In particular, FreeTaxUSA and OLT.com are free for all federal returns regardless of complexity. There’s also Cash App Taxes, which isn’t part of the Free File program but is apparently free for both federal and state returns and supports many different situations. I haven’t used any of these so I can’t say how well they work in practice, but I encourage you to consider them assuming you don’t have the same reservations about commercial software that I do.)

Finally there’s IRS Free File Fillable Forms, which provides online versions of tax forms to be filled in. The software handles some basic arithmetic but doesn’t provide any guidance, so the overall experience is similar to filling out paper forms. This is what I’ve used for the past few years and it’s worked okay so far.

This is all at the federal level, but what about the state level? In California, there’s CalFile, which is similar to IRS Direct File. It has its own limitations, although it seems to handle more situations. Nonetheless, I still don’t qualify because of capital gains, and like with Direct File I’d like to see this expanded.

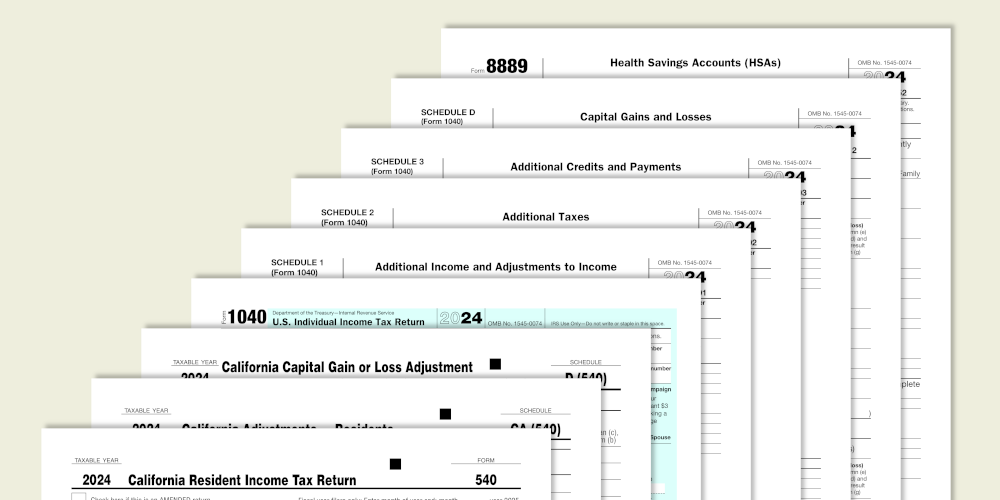

There’s no equivalent to Free File Fillable Forms for California income taxes, so I had to file on paper. The top image is not an exaggeration: I really did have to send all those forms, including the federal ones. (There are some cases where you have to attach a copy of your federal return, and mine was one of those cases.)

FOSS to the Rescue?

Out of curiosity I wanted to see if there was any free and open-source software (FOSS) in this area. There appear to be two significant projects:

- UsTaxes.org is an online program, although everything happens in the browser so all information remains private. It hasn’t been updated yet for the 2024 tax year, but it seems pretty nice.

- OpenTaxSolver is a desktop program. The GUI is a bit clunky and it requires more familiarity with the tax forms, but it still performs a lot of the calculations.

It’s important to note that these programs don’t actually file your taxes electronically. What they do is provide PDF files that you print and then mail (or copy into Free File Fillable Forms, I guess), which is a significant disadvantage compared to the proprietary software most people use. Still, I think they have potential as alternatives, and I encourage anyone who’s interested to contribute to their development.

Conclusion

Overall, filing income taxes is still dominated by commercial software, with some emerging alternatives that may work for some people. If any of these alternatives work for you, I encourage you to try them. I definitely hope that they continue to be developed so that more people can use them and avoid paying for something that, let’s be honest, really shouldn’t have to be paid for.